Introduction

It's unlikely that the concept of dividends on its own is what you have problems understanding. There is potential for confusion regarding the record date and the ex-dividend date. This is the day before the dividend will be distributed to shareholders. Let's begin with the fundamentals because dividends on stocks are one of those investment words that get thrown around like a Frisbee on a hot day.

Why Issue a Dividend?

It is up to a corporation's board of directors to decide whether dividends will be distributed to the company's shareholders. Simply put, a portion of the company's profits is distributed to the shareholders. Companies are cautious about reducing or eliminating dividend payments because many shareholders consider a lengthy track record of continuous payments to indicate a sound investment. This causes firms to be in a difficult position.

Ex-Dividend Date:

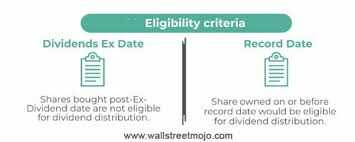

As was said earlier, stockholders are not entitled to receive a stock dividend as of the ex-date, also known as the ex-dividend date. Even if you buy a stock the day before it goes ex-dividend, there is a chance that you will still be entitled to the dividend payment. Instead, to sell shares while retaining the dividend that has been declared, you will need to wait until the ex-dividend date. The date will be recorded the second business day after the date that will be considered invalid.

In most cases, the ex-date comes one business day before the record date. Shareholders who acquire shares on or before the ex-dividend date will be formally registered as owners of shares as of the record date. This means that they will receive any dividends declared after the record date. Consequently, they will be entitled to receive the dividend payout. Because of this, the person who sold the stock will be the official record holder and the beneficiary of any dividends.

Date of Record

The corporation will have a comprehensive list of its investors and, by extension, a comprehensive list of the individuals who are qualified to receive the dividend on the day the record is kept. If your name does not appear on the list, you will not be qualified to collect the award since you will not meet the requirements. The T+2 method is used to settle transactions on the modern stock market.

This indicates that the official record of a transaction is not updated until the second business day following the day on which it genuinely occurred, even though the transaction took place on the first business day on that date. To be considered a shareholder of record, you must have purchased the shares at least two business days before the record date or one day before the ex-dividend date, whichever comes first. If you do not meet either of these requirements, you will not be counted as a shareholder of record.

The record date is also used to identify whether shareholders are eligible to receive financial papers from the corporation, such as proxy statements, annual reports, and quarterly earnings reports. These documents include annual reports, quarterly earnings reports, and proxy statements. This can be done by determining who the appropriate recipients were on the date when the record was created. Paying attention to both the record date and the ex-dividend date is essential for any investor who wants to ensure that they are qualified to receive the dividends they have their sights set on.

Difference Between Ex-Dividend And Record Date

Two dates stand out when discussing the purchase of stocks, the completion of tax forms, and the receipt of dividend payments: the record date and the ex-dividend date. These days, determinations will be made on which stockholders are eligible to receive dividend payments. The day that the dividend is declared, the day that the dividend is publicized, and the day that the payment is made are all important dates in this procedure (the date dividends are distributed).

The distribution of a company's profits to its shareholders can be accomplished through the use of dividends. Dividends can be distributed in the form of cash, shares of stock, or even actual corporate property. Most dividends are paid out in hard currency, either through direct deposit or by sending a check to the receiver. Dividends on stocks are not distributed in cash but are invested in further company stock.

Can I Sell My Shares on the Record Date and Still Get the Dividend?

If you were a shareholder as of the record date, you would not lose your eligibility to collect your dividend payment. You need to have purchased shares before they went ex-dividend to be eligible for the record date. In that situation, you do not qualify as a shareholder in the company.

Conclusion:

The date that the payment is made is the only other date that is relevant. On this date, dividends are dispersed to stockholders already on record for receiving payments. It is permitted to submit the record at least a week after its creation. Although it could appear to be a good approach to generating quick money, it isn't. The only thing that needs to be eligible for dividend payment is to purchase a share of stock two business days before the record date.